What Does Amur Capital Management Corporation Do?

What Does Amur Capital Management Corporation Do?

Blog Article

The smart Trick of Amur Capital Management Corporation That Nobody is Discussing

Table of ContentsWhat Does Amur Capital Management Corporation Mean?Fascination About Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedThe Buzz on Amur Capital Management CorporationLittle Known Questions About Amur Capital Management Corporation.The Amur Capital Management Corporation PDFs

International direct financial investment (FDI) takes place when a specific or service owns at least 10% of a foreign business. When capitalists own much less than 10%, the International Monetary Fund (IMF) specifies it simply as component of a stock portfolio. Whereas a 10% ownership in a business doesn't offer an individual capitalist a regulating interest in a foreign business, it does allow influence over the business's management, operations, and total plans.Firms in creating countries require international funding and expertise to broaden, give structure, and direct their international sales. These international firms require personal investments in facilities, power, and water in order to enhance jobs and wages (capital management). There are various levels of FDI which range based on the sort of companies entailed and the factors for the financial investments

Top Guidelines Of Amur Capital Management Corporation

Various other forms of FDI include the acquisition of shares in a connected venture, the incorporation of a wholly-owned firm, and engagement in an equity joint venture throughout international borders (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1712311217&direction=prev&page=last#lastPostAnchor). Capitalists that are preparing to participate in any sort of FDI could be wise to evaluate the financial investment's benefits and drawbacks

FDI boosts the manufacturing and solutions market which results in the development of tasks and helps to decrease joblessness rates in the country. Increased work translates to higher incomes and furnishes the population with more acquiring powers, boosting the general economic climate of a nation. Human funding included the expertise and skills of a labor force.

The development of 100% export oriented units assist to help FDI investors in enhancing exports from various other countries. The circulation of FDI into a nation translates into a continuous circulation of forex, helping a nation's Reserve bank keep a thriving book of forex which results in secure exchange rates.

The Of Amur Capital Management Corporation

International straight financial investments can occasionally influence exchange prices to the advantage of one country and the detriment of one more. When capitalists spend in foreign regions, they might discover that it is much more pricey than when products are exported.

Taking into consideration that foreign direct investments may be capital-intensive from the point of sight of the financier, it can occasionally be very dangerous or economically non-viable. Lots of third-world nations, or at least those with background of colonialism, worry that international straight investment would certainly result in some kind of modern-day economic manifest destiny, which subjects host countries and leave them vulnerable to international business' exploitation.

Preventing the achievement gap, boosting health outcomes, boosting revenues and giving a high rate of economic returnthis one-page record sums up the advantages of spending in quality very early childhood years education and learning for disadvantaged children. This record is usually shown policymakers, advocates and the media to make the situation for very early youth education and learning.

The smart Trick of Amur Capital Management Corporation That Nobody is Discussing

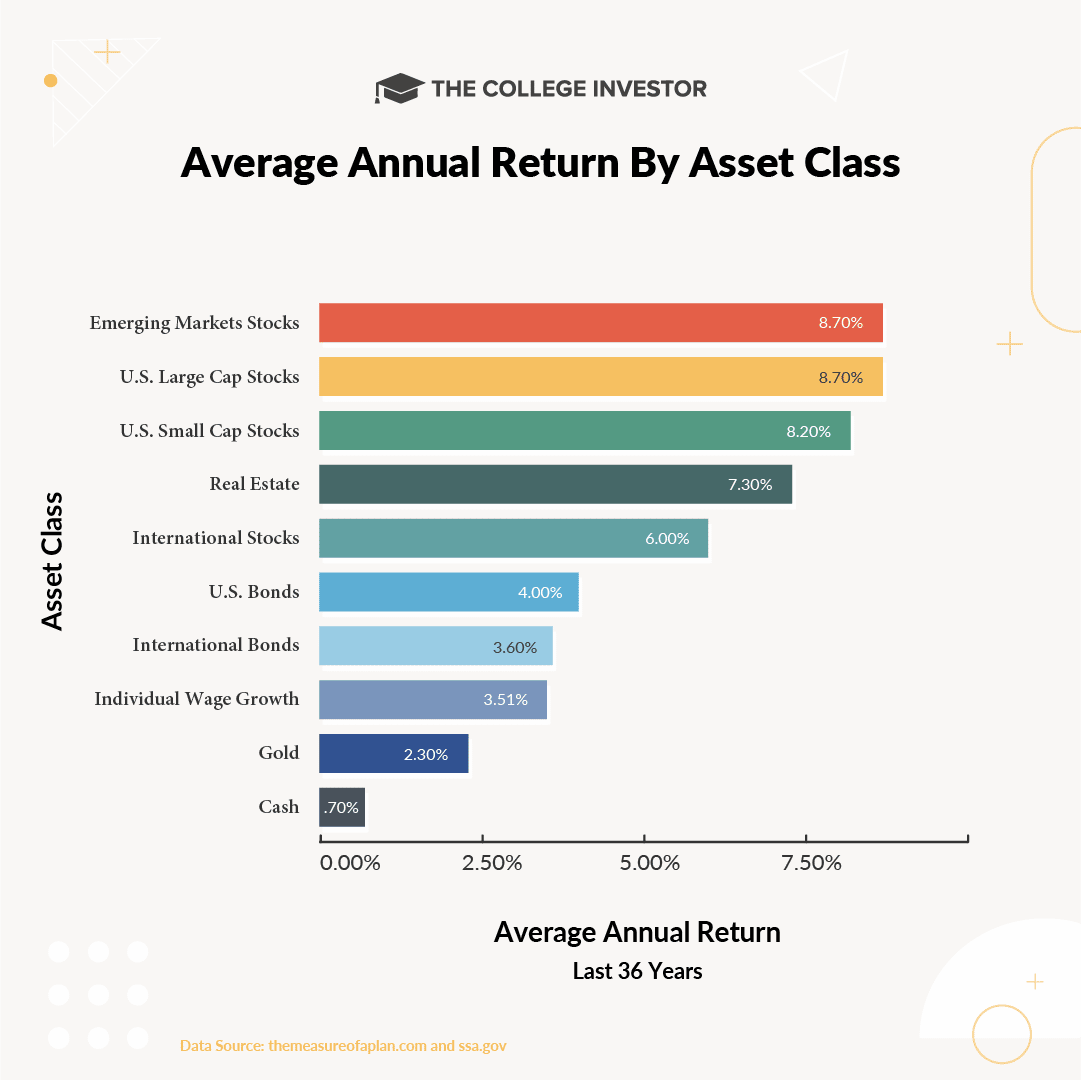

Take into consideration exactly how gold will certainly fit your financial goals and lasting investment plan before you invest - accredited investor. Getty Images Gold is usually taken into consideration a strong possession for and as a in times of unpredictability. The rare-earth element can be appealing via periods of economic unpredictability and recession, in addition to when inflation runs high

Not known Factual Statements About Amur Capital Management Corporation

"The suitable time to build and allot a design profile would certainly be in less unpredictable and demanding times when emotions aren't regulating decision-making," states Gary Watts, vice president and monetary advisor at Wealth Enhancement Group. Besides, "Sailors outfit and stipulation their boats before the storm."One method to determine if gold is right for you is by researching its advantages and downsides as a financial investment selection.

So, if you have money, you're effectively shedding money. Gold, on the various other hand, may. Not everyone agrees and gold might not constantly climb when inflation rises, however it can still be an investment factor.: Getting gold can possibly assist investors obtain via unpredictable financial conditions, taking into consideration the during these durations.

Get This Report about Amur Capital Management Corporation

That doesn't suggest gold will always increase when the economy looks unsteady, but maybe excellent for those that intend ahead.: Some investors as a method to. Rather than having every one of your cash linked up in one property course, various could potentially assist you much better manage threat and return.

If these are some of the advantages you're looking for then start spending in gold today. While gold can aid add balance and protection for some capitalists, like many financial investments, there are likewise risks to enjoy out for. Gold might exceed various other assets during certain durations, while not standing up also to long-lasting rate gratitude.

Report this page